Are you searching for PayPal alternatives? If you are a freelancer or blogger or online entrepreneur, you must have used PayPal. No doubt PayPal is the best online payment service. With this, you can receive payments from any part of the world, and you can send money to any part of the world. Because of its high transaction fees, many people like me searching for PayPal alternatives.

There is plenty of medium for money transactions apart from PayPal. No doubt, PayPal is a milestone but if you want to give a try for PayPal alternatives they are also appealing. They are important in your day-to-day lives of personal and working lives. Options are unlimited when it comes to having PayPal alternatives, but it depends on which online payment mode you want to choose for your use. In the new phase, you want to have the most prompt option of payment then go for any of the top 5 alternatives to PayPal.

- Related: What is Freelance work? How to Become a Freelancer

- 6 Top Freelance Websites to Hire freelancers online

Top 6 PayPal alternatives

1.Payoneer

Payoneer is my first choice after PayPal because of its fewer transaction fees. You will find a huge difference in transaction costs. It is a fast-growing online payment service. Day by day it is increasing its merchant’s list. Receiving global payment is very easy. It will give you virtual bank account details in the US, UK, Europe, Japan, Australia, Canada, and Mexico. If you want to receive payment from these countries, you can give bank details to the merchant for direct deposit. So when you have a Payoneer account, you are indirectly having a bank account in the above-mentioned countries. After making the first $100 transaction with Payoneer, you will get a $25 bonus from Payoneer. It is true, I have received a $25 bonus after making a $100 transaction with a Microsoft affiliate using Payoneer.

Most marketplaces have integrated pioneer with their payment system which makes the user’s life simple. Example

2.Skrill

Skrill is integrated with all excellent features. It is capable of sending and receiving money in no time, and it does not charge high interest per transaction. It better controls your all online payment dealing and it is quite transparent with its entire customer, so there is no confusion among them about the interest increase or reduces. Skrill is a perfect fit for overseas dealing, and your money is no more far for you.

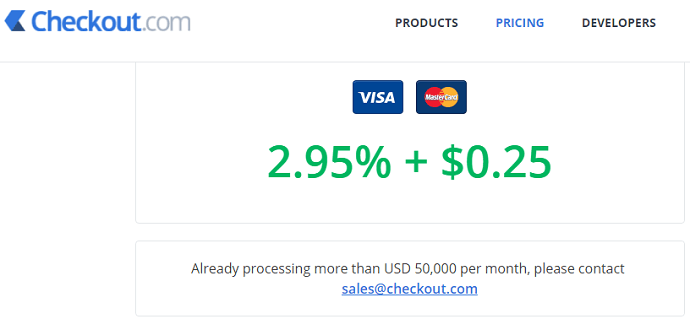

3.CheckOut

CheckOut offerings are unlimited. It is crafted in a way to give convenience at its best. CheckOut is basically for the sending and receiving the payments globally without hassle. Its interface is impressive and easy to use. It has also fanatically million of users. It is featured with fraud protection, simple implementation and can be utilized worldwide. All the customers willingly use this Paypal alternative to explore accessibility for online transactions. Its transaction fee depends on the card type:

- For European Cards: 0.95% + $0.20

- For Non-European cards: 2.90% + $0.20

- Read: What is Affiliate Marketing? How to Start it?

- 4 Must have Affiliate Marketing tools Everyone should know

4.WePay

The integrated features lie in this Paypal alternative that makes the payment instantly. So no more wait for a longer period to send and receive the money overseas. It offers free registration, and this platform is responsive, and it is a complete payment solution for all. It is a sporting free integration of fraud protection. It supports all kinds of billing processes of any amount. So the developer intelligently planned the WePay.

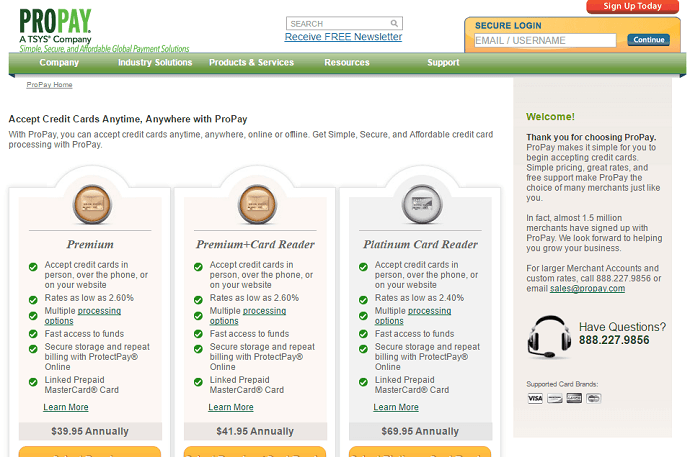

5.ProPay

ProPay is impeccable and offers robust integration for the users. The user’s experience is fine, and this PayPal alternative is supportive of iOS or Android. The money transaction is seamless and quick. Its fast services make it more in demand. It is accessible anywhere in the world and finding it a more convenient option for long time use. It has millions of users, and no hassles will come across while dealing with this ProPay.

6.Google Pay

Google pay is one of the emerging payment methods of the current time. With the support and trust of google, this payment method is at its peak. This digital wallet is mainly designed for Mobile devices, but you can also use it to make a transaction through your system. The user must have a google account in order to sign up for the Google Pay service.

With google pay support, the user doesn’t need to pay extra for local transactions. However, currency transfer charges may apply for oversee transactions.

Supported countries: India, Canada, Japan, Australia, Russia, Singapore, United States, UK, Ukraine.

Conclusion:

You have all the stunning PayPal alternatives which are a real performer and make you use it amazingly. So you can register any of the online payment options that keep you away from all the hurdles. It makes you productive and fast. Let us know which payment service you are using.

- You May Also Like: 10 Best Affiliate Marketing Networks that I use on My blogs

- How to Autolink Affiliate links to Keywords in WordPress

- How to Geo-target affiliate links on WordPress?

If you like this article, please share this article. Want more blogging tips, follow BlogVwant on Facebook and Twitter.